This is What an EV World Could Be

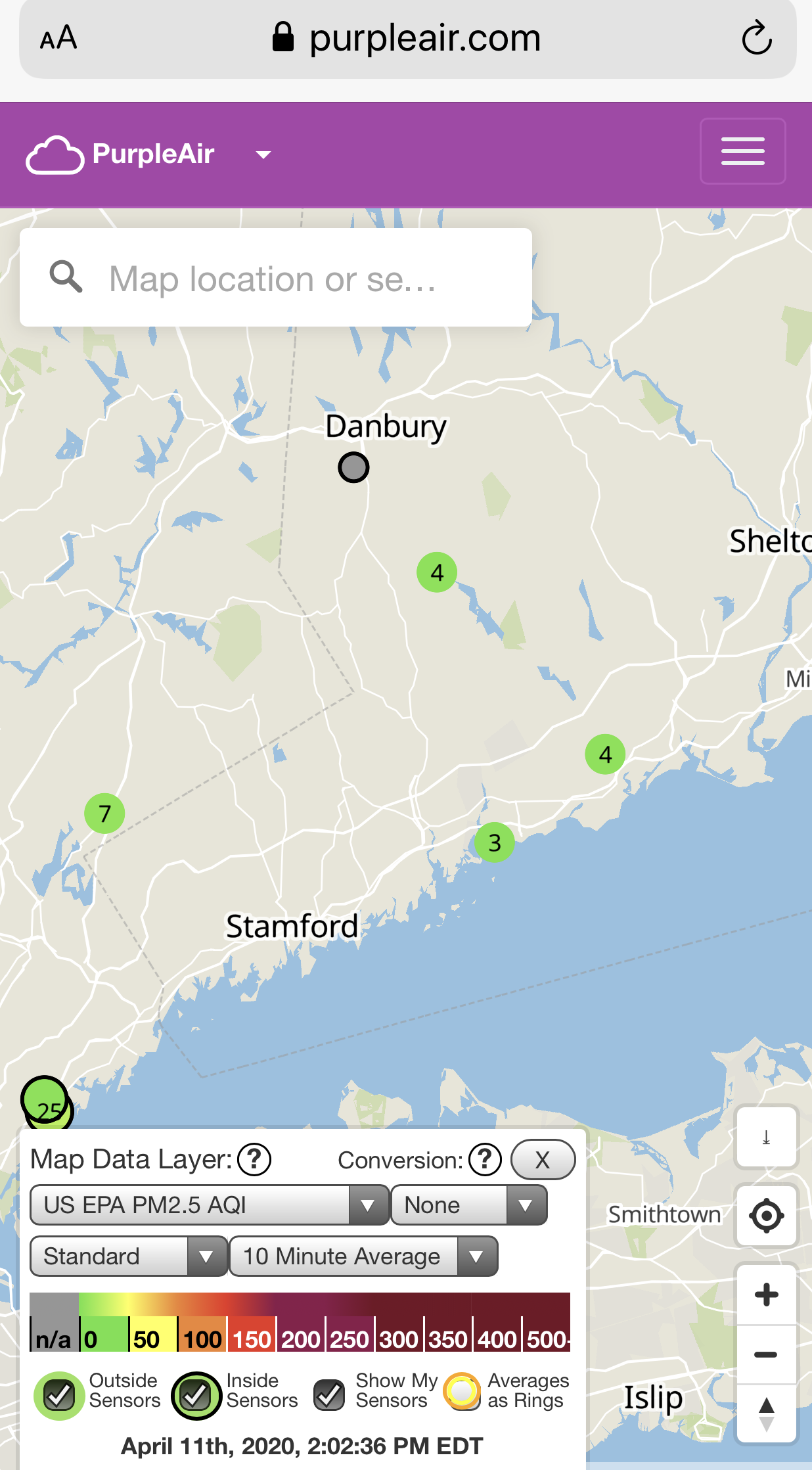

Coronavirus has given us clean air. EVs could, too. The photo above is from PurpleAir, which is a WiFi-connected, networked, sensor. The date is April 11, 2020. Individuals can buy these and the results are … Read more