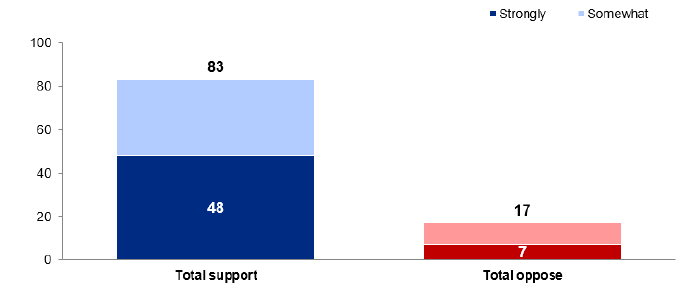

83% Support for Direct EV Sales in Connecticut

A poll released by the Electric Vehicle (EV) Club of Connecticut shows that a significant majority of Connecticut residents support direct sales from Electric Vehicle companies. 83% of respondents support direct sales of electric vehicles … Read more