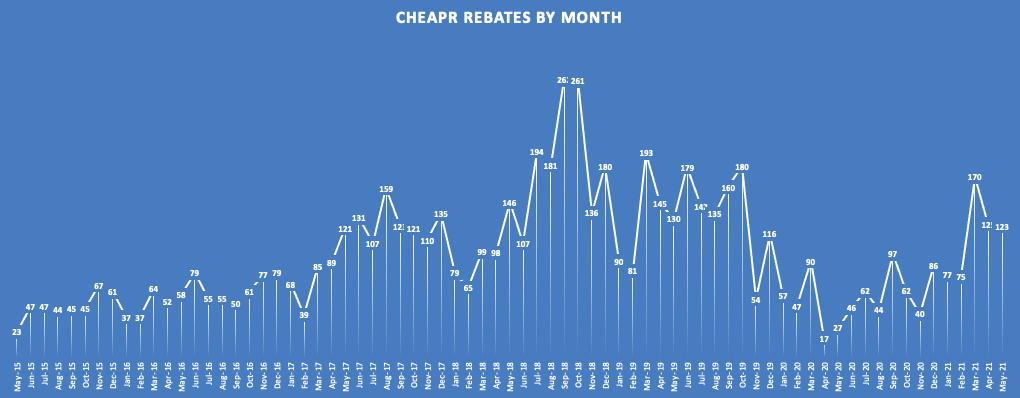

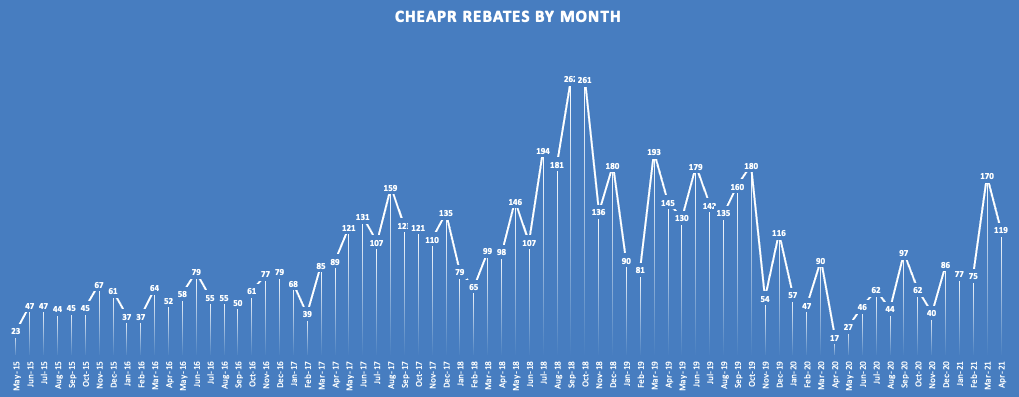

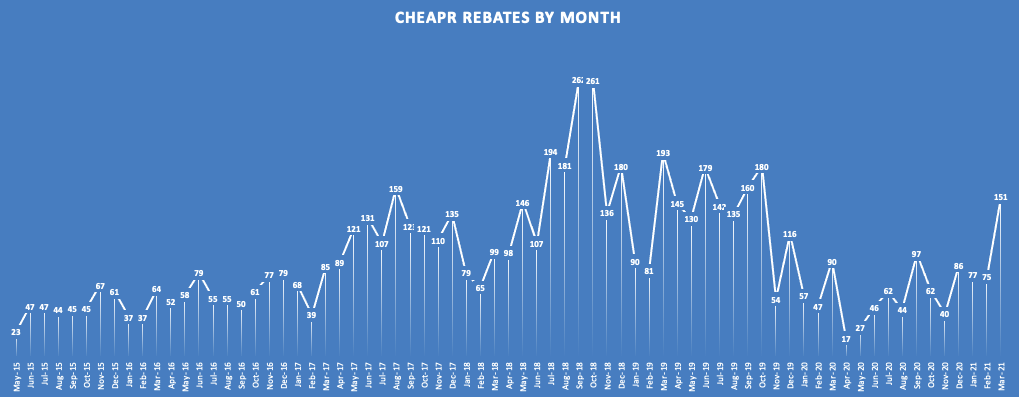

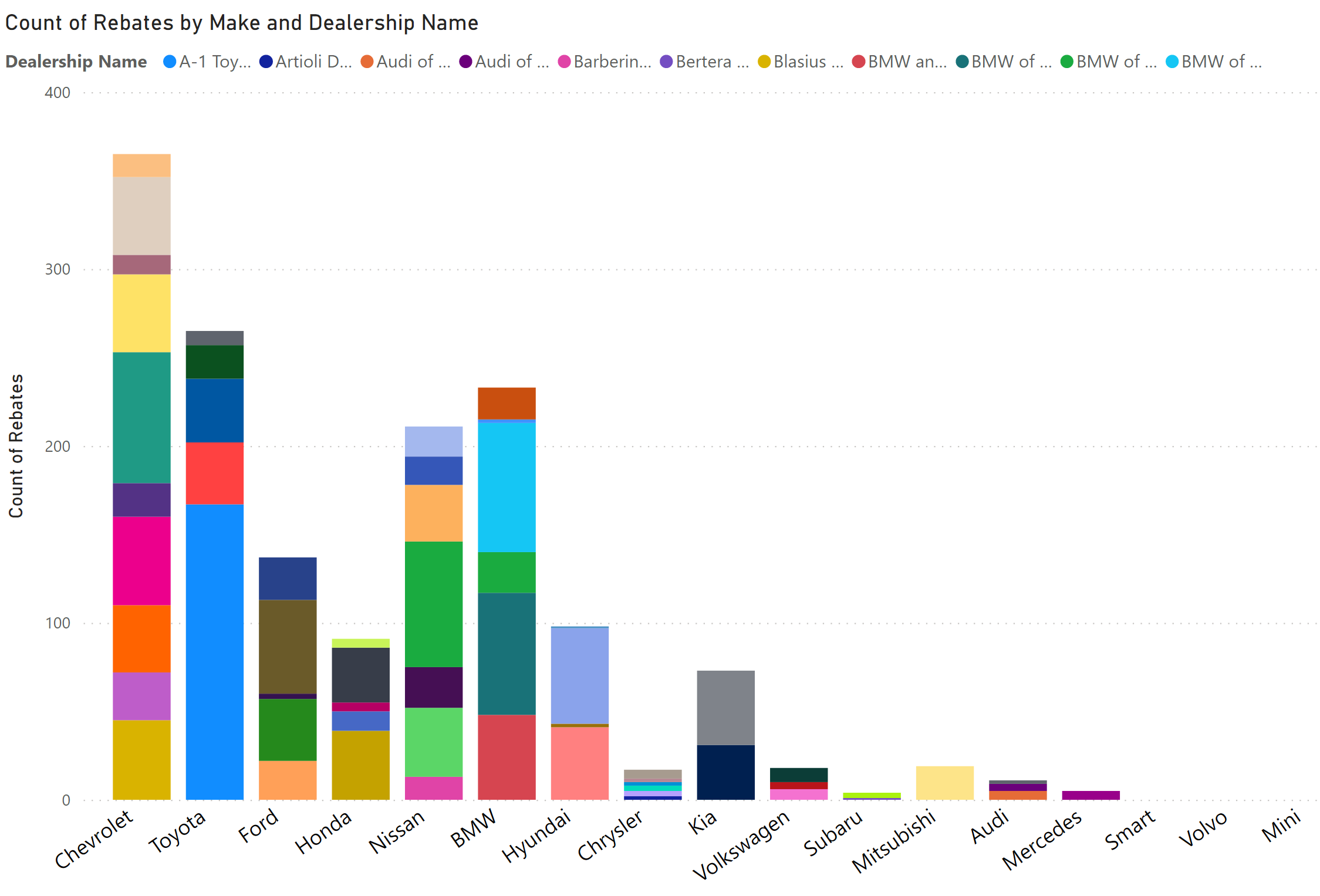

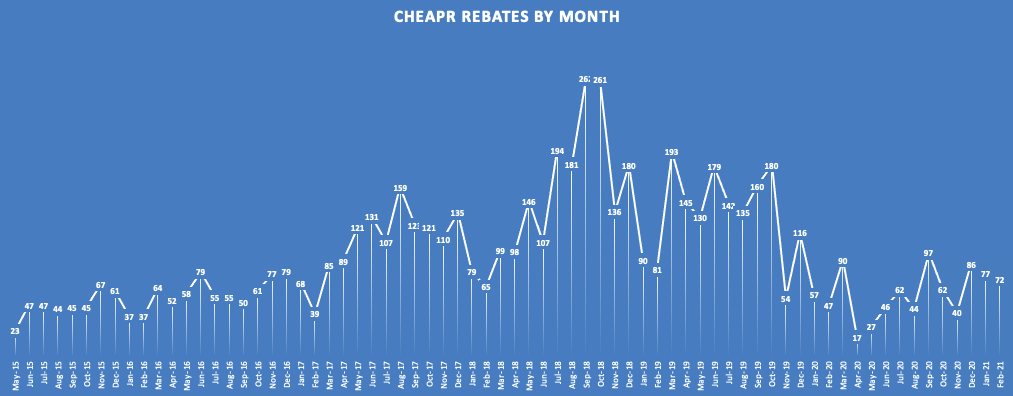

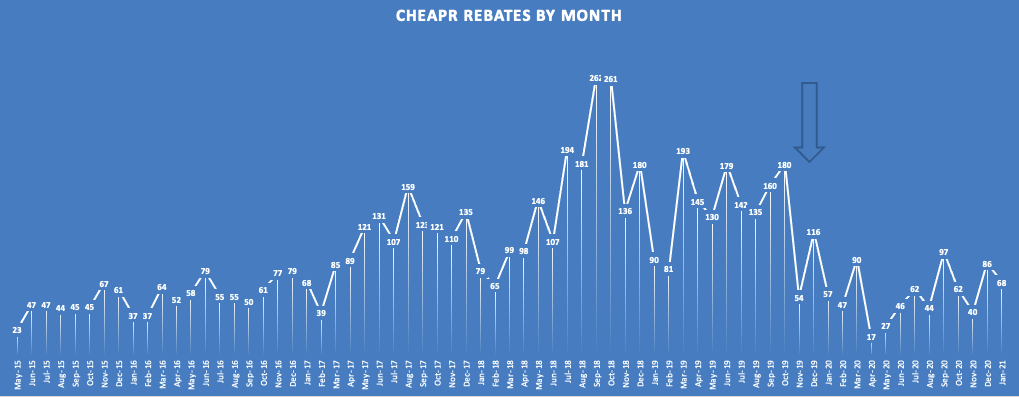

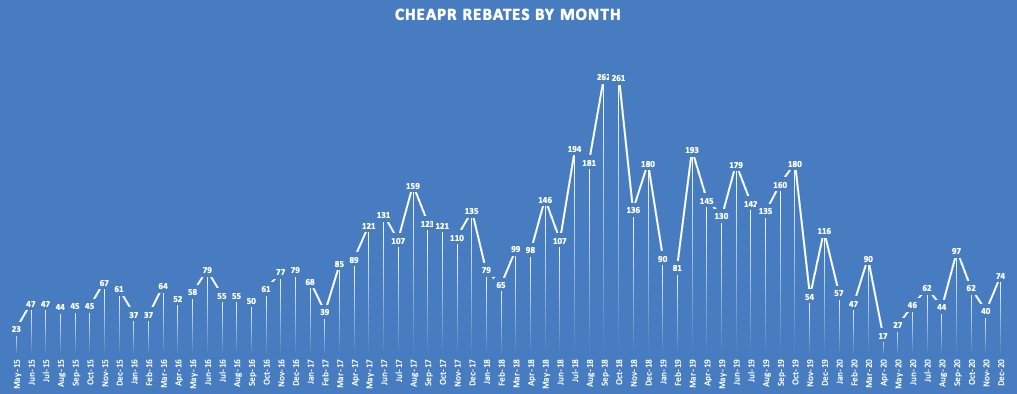

CHEAPR Data Through May 2021 and New Program Takes Effect

Toyota Dominates May Rebates The two plug-in hybrid offerings from Toyota dominated the rebate activity for May. The Prius Prime (44 rebates) and the RAV4 Prime (30 rebates) together accounted for 61% of the 123 … Read more