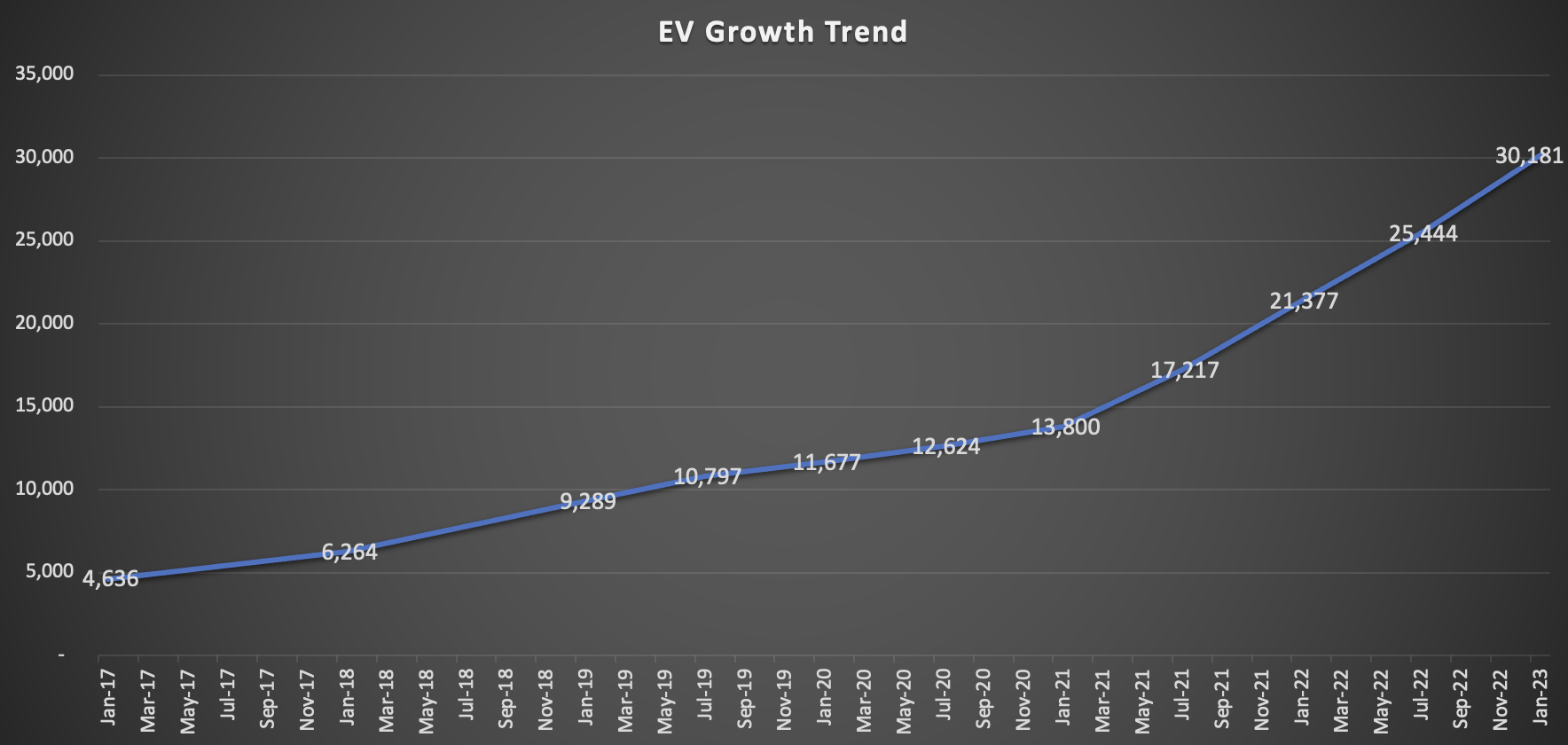

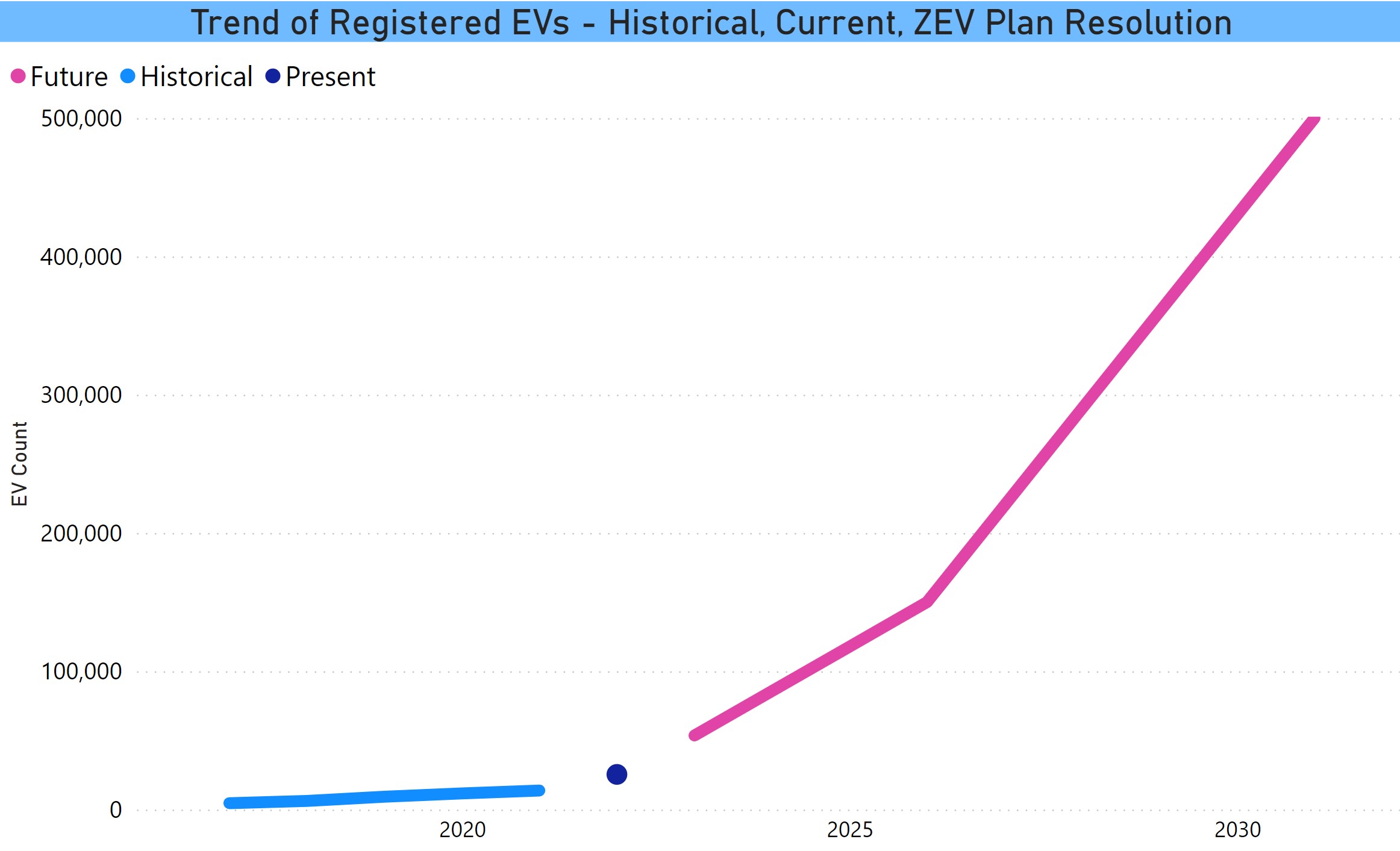

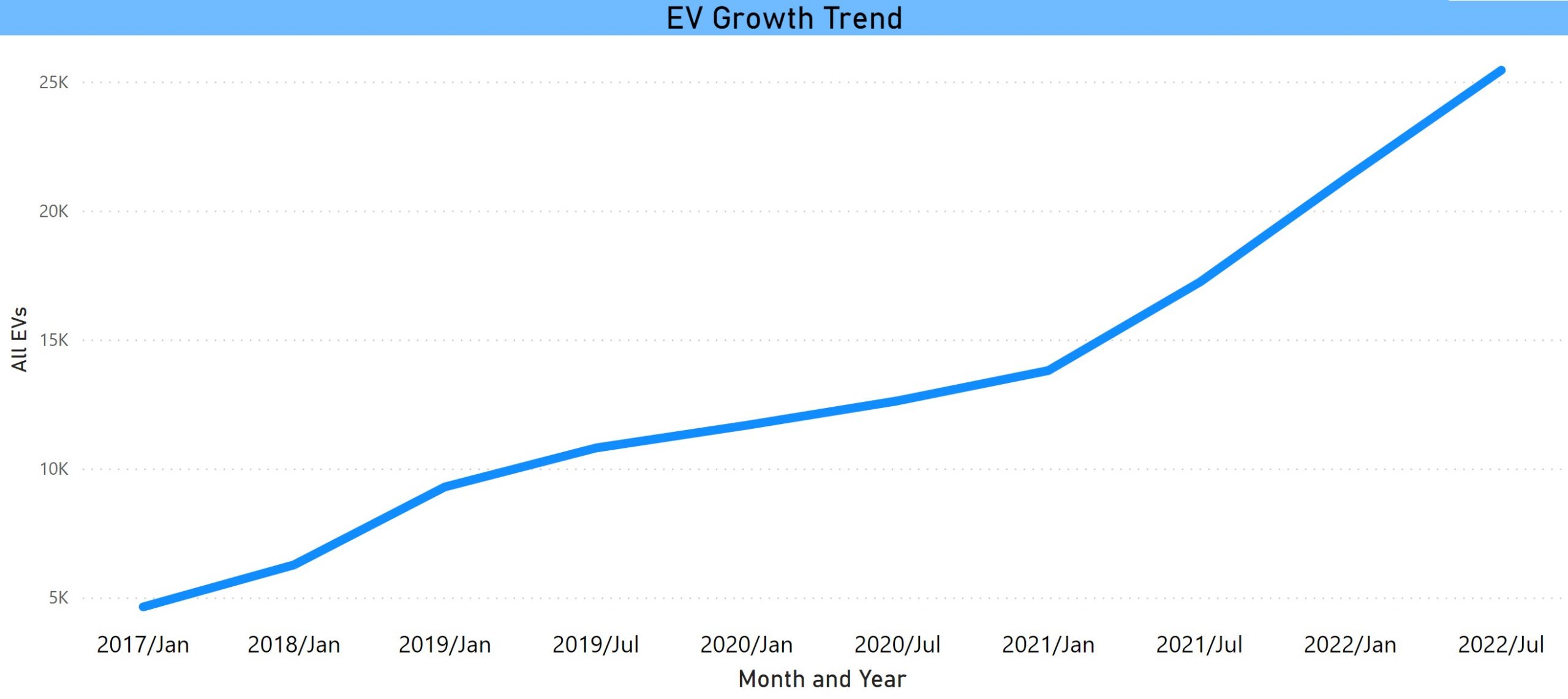

Connecticut EV Registrations Increase to 30,181

Based on new data released by the Department of Motor Vehicles, Department of Energy and Environmental Protection, and the Department of Transportation, the number of electric vehicles on the road has increased to 30,181 up … Read more